Many investors end up holding large concentrated positions in single stocks, whether as the result of employee compensation or a handsomely rewarded stock selection. Familiarity with these stocks or a successful track record while holding them may discourage investors from diversifying. Unfortunately, this can lead to one of the most well-known cautionary tales in finance: tragic declines in wealth from losses in single securities. And data on the behavior of individual stocks suggests it’s hardly rare for firms to underperform—or even go under—regardless of past performance.

SHIFTING LANDSCAPE

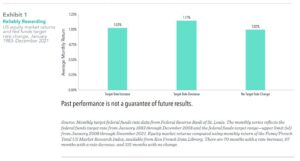

Industry development and innovation are signs of a healthy economy. Financial markets reflect this dynamic through the birth and death of public companies. As shown in Exhibit 1, this translates to meaningful turnover among individual stocks. The average survivorship statistics over rolling periods imply a little over one in five US stocks available in the market at a given time delist within five years. The survival rate goes down over longer periods, with just under half of stocks on average still trading 20 years later.

Not all delistings produce the same experience for investors. We categorize these delisting events as “good” or “bad” based on the circumstances for each stock. For example, a stock delisting due to a merger would be a good delist, as the shareholders of that stock would be compensated during the acquisition. On the other hand, a frm that delists due to its deteriorating fnancial condition would be a bad delist since it is an adverse outcome for investors. Over 20 years, about 18% of stocks went the bad-delist route on average. Most of us yearn not just to survive but also to thrive. Looking at the last row of Exhibit 1, only a minority of stocks have achieved that. A little over a third of stocks on average survived and outperformed the broad US market over fve years; this rate dwindled to a little more than one in fve over 20 years

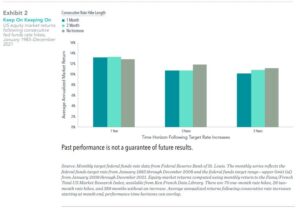

The range of returns for single stocks is vast, even among those surviving a long time. Exhibit 2 shows distributions of excess returns for surviving stocks over rolling periods of five, 10, and 20 years formed using the average cumulative return in excess of the market at each percentile. The median stock underperforms the market across all three horizons. Not until we reach the 57th, 57th, and 56th percentiles at the 5-, 10-, and 20-year horizons, respectively, do we see positive excess returns relative to the market. Although the percentage of underperformers is similar across time horizons, the magnitudes of excess returns at the extremes are smaller at longer horizons.

WHY DIVERSIFICATION PAYS

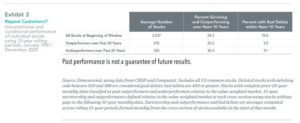

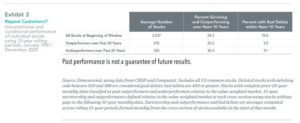

For investors holding stocks with a long history of beating the market, diversifcation might seem like “worsifcation,” reducing expected returns relative to a more concentrated approach. In many cases, these stocks represent successful companies that investors believe will continue to prosper and buck the broad trend of adverse outcomes for single stocks. Unfortunately, a long-term track record of outperformance generally

has not been an indicator of future outperformance. Take, for example, stocks that have outperformed the market over the previous 20 years. Exhibit 3 shows that, on average, about 30% of these stocks continue to survive and outperform over the following 10 years. Of the stocks that have underperformed over the previous 20 years, the average

subsequent outperformance rate is also 30%. In other words, winners have been no more likely than losers to beat the market in the future.

Outperformers do tend to experience a lower bad delist frequency than

underperformers, which likely refects the impact of strong performance on firm size. For example, looking at the same data set of US stocks from CRSP and Compustat, the median market cap of past winners was $4.2 billion as of December 2020—compared to $800 million for past losers. However, the bad delist rate is still 3.0% even for past outperformers; the bankruptcies of companies like Enron, Chesapeake Energy, and Circuit City remain fresh memories for many investors and former employees of those

A well-diversifed portfolio can help investors reliably capture market returns, limit individual stock risk, and improve the ability to tilt toward segments of the market with higher expected returns. Even when accounting for capital gains taxes, transitioning from a concentrated portfolio to a broadly diversifed one can deliver higher growth of wealth. The long-term benefts of diversifcation can outweigh the short-term costs associated with liquidating outsize positions. Personalized vehicles can be used to further tailor

investments, manage taxes, and suit individual considerations

By: Bryan Ting, PhD

Researcher

Sources: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value Dimensional Fund Advisors does not have any bank affliates.