What do mean stock investors and Wall Street have in common, and where are they different? How does humanity’s tendency to persevere show up in the market? I enjoyed the article below by David Booth from the Dimensional Fund Advisors website. I hope you enjoy it as well.

-Neel

We’ve all been conditioned to see meme investors and Wall Street in opposition, but it seems to me that they have a lot in common. Both believe in picking stocks and think they can beat the market. In my mind, the important distinction is that Wall Street stands to make a lot of money off meme investors, simply from trading costs. For those who say apps don’t charge for trading, think about it: When was the last time Wall Street gave away anything for free?

I think the best long-term investing strategy has little to do with prediction or stock picking, and everything to do with investing in human ingenuity. Human ingenuity is the engine that drives the stock market. The real anti-Wall Street revolution began in academia in the 1960s and evolved into the formation of index funds more than 50 years ago. The academics spearheading this revolution found no compelling evidence that any individual can consistently beat the market, but that the market itself returns, on average, about 10% a year.

Why do individuals have such trouble beating those returns?

In transparent public markets governed by the rule of law, enormous numbers of buyers and sellers come together to trade. Both sides of every trade must feel like they got a good deal. Otherwise, they wouldn’t trade. That’s what people mean when they say prices are fairly set.

When Wall Street or meme investors think they can capitalize on “mispricing,” they’re not betting against Wall Street so much as they are betting against human ingenuity.

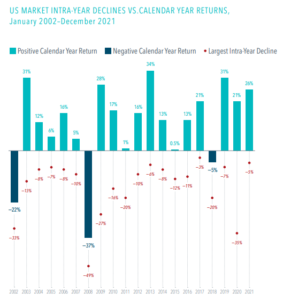

So when you bet on individual stocks, you might win or you might lose, but over 10 years, you’re unlikely to harvest a better return than if you invested in the whole market. If you stop and think about it for a minute, this makes sense. Markets only work if they are unpredictable. After all, they are constantly responding to all the new information that comes in every day. If we could predict when the market was going to move, there would be no market. The fact is nobody knows when a certain stock will go up or down. Contrary to what both Wall Street and meme investors want you to think, there is no method of analysis, no matter how “proprietary” or sophisticated, that tells us what’s going to happen when.

So when Wall Street or meme investors think they can capitalize on “mispricing,” they’re not betting against Wall Street so much as they are betting against human ingenuity. I’m referring to the millions of people working hard to maximize the value of their companies, and millions of investors trying to make the best possible trading decisions based on all available information. Sometimes speculators get lucky, and sometimes they don’t. Regardless, I don’t call what they’re doing investing. I call it speculation—even gambling.

Buying the market is a totally different approach. It’s investing in human ingenuity. People working to maximize the value of public companies are innovative and resilient. They adapt to improve products. They create new processes to solve problems. While you can’t predict what any one person will do on any given day, you can predict that humanity will persevere. The market reflects this simple truth.

The market can reward us for having faith in our fellow human beings. Investing—like life—is full of uncertainty, but at the end of the day, it’s uncertainty that drives opportunity, and returns. Investing is not about trying to outguess Wall Street or meme investors on which stock will go up or down and when. It’s about choosing to side with human ingenuity and betting on a future that’s better than today—because of the hard work of everyone you know, and the many millions you will never meet.

David Booth

Executive Chairman and Founder

Sources: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.