Join me with my livestream.

Come join me on my facebook page

Shah Total Planning

Responsibility of Living in the Greatest Country in the World

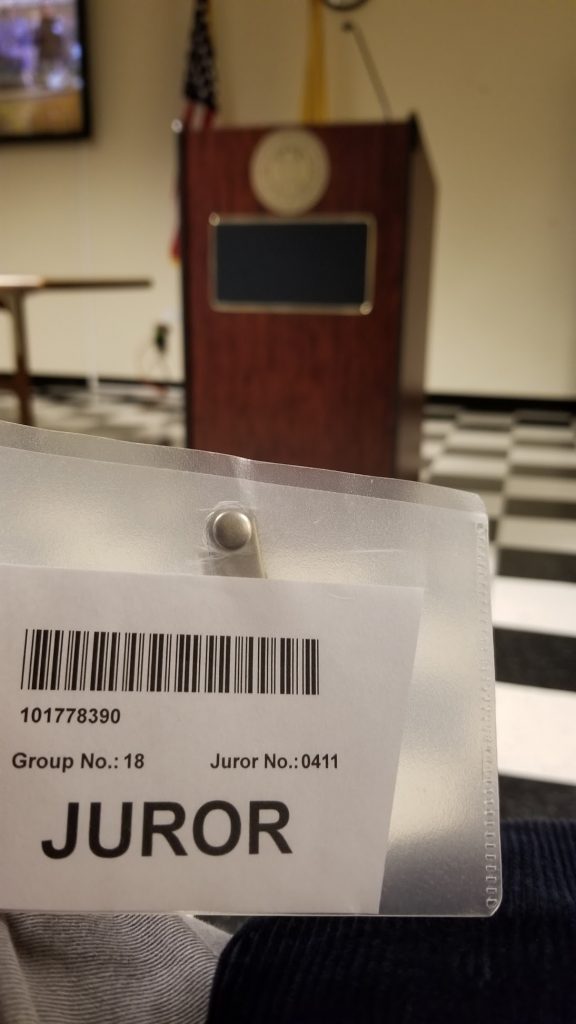

Over the last few weeks, I had the privilege of telling people that I was scheduled for Jury duty. Last Monday, I had to report to Middlesex County Superior Court for Jury duty at 8 a.m. in New Brunswick. 8 a.m. is early, especially if you are heading into a parking deck after battling route 18 traffic through East Brunswick.

Over the span of the several months that I had Jury duty scheduled, whenever I told people about it, the initial reaction I got was a look of sadness followed by, “But you’re a Lawyer, you should be able to get out of Jury duty, right?” Occasionally I would even get people telling me, “This is how you get out of Jury duty…” and they would proceed to share with me some funny ideas on how to get out of Jury duty.

Admittedly, Jury duty was not something for which I would volunteer. However, and I became more aware of this when I was there, it is a very important responsibility for the citizens who live in the greatest country in the world. In the end, I was not selected for a Jury. And I was relived – given the responsibilities I have for my family, for my clients & for my team. But what is everybody felt that way? No one would ever have their disputed heard by a Jury of our peers. We live in the greatest country in the world; this is our chance to do our part..

There are other parts of our lives in which we have responsibilities as well. For example:

- When you have a family or a cause for which you care deeply, it is important that you choose what happens with your legacy.

- When you have young children, you want to make sure that you meet your responsibility of taking care of them.

- When you have adult children, your responsibility may be to leave behind a legacy or to protect your spouse against the cost of long-term care.

If we can help you to meet your responsibilities, please do not hesitate to reach out. I hope you enjoy the Articles below and remember: you are welcome to schedule a 15-minute call if you ever want to chat about those responsibilities.

The Power of Special Needs Planning & America’s Got Talent

This video has been making its rounds on Facebook and other forms of social media and, in my opinion, it is impossible to watch this without tearing up. For any parent, it is an amazing feeling to nurture a gift or a skill that your child develops and to ultimately see them perform at the highest level.

However, when a child has special needs, there may be a temptation to set the bar a little lower: the story of Kodi Lee is nothing short of jaw dropping. But it is also a testament as to what the power of love and nurturing can accomplish for any child, even a child with special needs. Kodi Lee is blind and has autism. However, with his mother’s love and family’s support, Kodi Lee accomplished what you are able to see in the video above.

All parents wish for their children to achieve their potential. If, God forbid, something did happen to the parents, either a disability or an incapacity, parents must plan to leave behind sufficient resources (money) to accomplish this goal. I hope you enjoy the video and I hope it inspires you. If you or someone in your life has a child or an adult with special needs in their life, please forward this video to them. And if they haven’t taken care of any planning, please encourage them to do so. It doesn’t have to be complex, but it does have to be done. Have an amazing day.

Proposed IRA Stretch Law Which Could Cost You & Your Kids Lots of Money

Congress has a way of keeping things interesting, don’t they? HR 1994 is also known as the SECURE act. SECURE stands for “Setting Every Community up for Retirement Enhancement”, but as is often the case-it may have you feeling a little less than “secure.”

- the required minimum distribution age would be raised from 70 1/2 to 72 (not that big of a deal),

Leaving your Furniture on the Front Lawn?

When looking into Estate Planning, a common misconception is that creating your trust/ signing your carefully planned trust documents is all that needs to be done. Whether you have a trust (revocable or irrevocable) or a will, it is crucial that you align yourassets with your trust.

Asset alignment, or “funding,” can refer to renaming your non-retirement assets (bank accounts, investments, stocks, etc.) under your trusts name, as well as designating your trust as a beneficiary for your retirement accounts and/or insurance policies.One of the main reasons for forming a trust is to avoid probate—a public, time-consuming and (for some states) costly process. Forming the trust is not enough to avoid probate; only the assets that are owned by your trust are protected.

So what goes where? The Asset Integration Worksheet we provide gives specific recommendations on what to do with each of your individual assets. What happens if I pass away before funding my assets? Thanks to the Pour-Over Wills we prepare, any assets that were not moved to your trust by the time you pass will “pour” into your trust, maintaining your privacy; however, they will likely need to go through probate.It is important that your assets align with your plan.

If you are interested in forming a trust to ultimately fund your assets into, or you are simply not sure how to start (or finish) your process, please give us a call 732-521-9455; we exist to help you!