As a member of probably the last generation to grow up with a rotary dial phone in the house, I can still recall when there was clear distinction between phones and computers. Phones were utilitarian devices, while computers were gateways to limitless knowledge and entertainment.

Nowadays, that distinction has dissolved. For many consumers, phones arguably obviate the need for a personal computer.

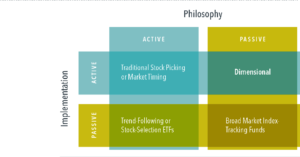

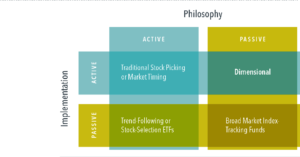

Similarly, evolution in finance has etched away the apparent cut-and-dried distinction between active and passive investing. The current landscape suggests the characteristics implied by such traditional, binary labels may not be sufficient to describe many of today’s investment approaches. A more nuanced framework takes the spirit of active and passive definitions—betting against market prices vs. embracing them—and examines how it applies to an investment’s underlying philosophy and implementation.

DIMINISHED DISTINCTION

Index investing emerged amid a growing body of evidence showing that traditional active methods of attempting to select stocks and time markets were ineffective. Studies documenting underperformance by active fund managers supported the sentiment that market prices were largely fair and any attempt to find under- or overpriced securities was akin to flipping a coin. So, the arrival of index funds represented a shift towards embracing market prices—if you can’t beat ’em, join ’em!

Because early indexing didn’t spin its wheels in bottom-up company analysis or top-down economic trend forecasting, it became known as passive investing. However, this stretches the definition of “passive.” A sailboat without its own propulsion must still be actively manipulated to keep wind in its sail. Indexes are not perpetual motion machines free of maintenance, but require periodic management through additions, deletions, and security reweighting. Index construction rules are often designed to accommodate the mutual funds and exchange-traded funds (ETFs) tracking the indexes, reducing index turnover, for example, by limiting the number of rebalancing events and imposing thresholds on security weight changes.

Also blurring the line between active and passive is the fact that some investors may use index funds to pursue an active investment approach. For example, the largest S&P 500 ETF had the highest average daily trade volume of US-listed securities in 2021, at $31 billion USD.2 It is reasonable to assume a portion of that trading activity represented asset allocation changes motivated by market viewpoints, rather than buy-and-hold position accumulation.

A more evolved process for categorizing investments applies the active/passive label separately for a strategy’s structure/implementation and its underlying philosophy. While some investment approaches still appear active or passive through and through under this framework, many investment styles have a foot in both camps.

Stock-picking and market-timing strategies would universally be described as active, and the 2×2 framework in Exhibit 1 shows how this label is earned. These approaches are rooted in an active philosophy that implicitly presumes mispriced securities or market segments can be identified. This philosophy is executed in an active structure that deviates from the market in an attempt to exploit mispricing opportunities.

Broad market index funds, on the other hand, fit a passive definition along both dimensions. The raison d’être of index funds is an acceptance of the market’s pricing power, a concession that trying to outguess markets is unlikely to succeed in the long term. The structure of the broad market index funds is true to that belief, generally holding the entirety of the prescribed asset class or market segment with no deviations motivated by expected-return goals.

Expansion of the ETF landscape has spawned a segment of index ETFs that do not track broad market indices, instead offering more targeted exposure for investors who are looking to time markets or concentrate on particular stocks. For example, you can find a social sentiment ETF that holds the top 75 large cap stocks based on investor exuberance measured through channels such as social media and news outlets. Another example is a millennial-themed consumer ETF that seeks to ride the coattails of companies benefiting from millennials’ consumption preferences. I hope its prospectus isn’t written in cursive!

These are but two examples of index funds that sit apart from traditional passive approaches. They track indices, so are passive in structure. But the philosophical underpinning of these niche ETFs would seem inconsistent with an acceptance of market prices. An investor who believes stock prices reflect available information about companies likely would not see the appeal of an allocation to trendy stocks based on a belief in their growth potential. Our framework assigns an active/passive designation to these index ETFs.

The final quadrant expresses Dimensional’s approach, which starts with a firm belief in the power of markets. In that sense, our philosophy is aligned with the industry’s original shift to passive. We use the information in prices throughout our investment process with an aim to increase expected returns daily, seeking to add value above markets and benchmarks. The implementation is therefore active—we are not beholden to the construction rules of an index. So, we land on passive/active: an approach that seeks to outperform markets without trying to outguess them.

By: Wes Crill, PhD

Head of Investment Strategists and Vice President

Sources: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.