What would happen if someone sues you? Do you have a plan? Or are you simply hoping this never happens to you?

While this situation can happen to anyone, certain people are perceived as bigger threats for lawsuits or creditors than others. Those in this situation take proactive steps to create an asset protection plan to decrease their overall risks.

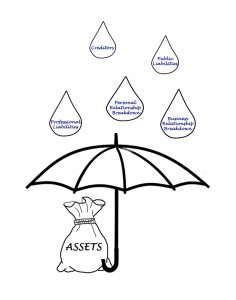

The process of asset protection planning involves making critical decisions today that will protect your business, yourself, and your hard-earned assets from loss due to lawsuits, bankruptcies, or creditors period. This form of legal planning is especially important for business owners and professionals whose personal assets could be threatened in the event of a claim of someone else.

Federal as well as state laws exempt certain assets from the claims of creditors. You can discuss with which of your assets might be exempted from creditor claims. New Jersey means that you must use the state exemptions.

Because federal bankruptcy exemptions are not available, it can make sense to enhance your protection by converting those non exempt assets into exempted assets. Finally, if you’re an entrepreneur with a business as a sole proprietorship, you may need to schedule the support of an experienced New Jersey asset protection planning lawyer.

A comprehensive

A comprehensive