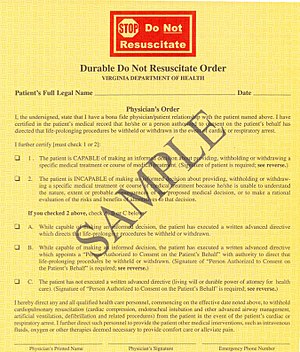

If a loved one has been diagnosed with a debilitating illness or dementia, there is a good chance that they will need care in a nursing home or the support of a skilled nurse in their own home at some point in the future. Turning to Medicaid to pay for these bills is often the first response of family members in crisis, attempting to help this loved one make such a transition.

A supplemental care trust may be a more appropriate option for leaving your estate to a family member who is expected to need government benefits, such as Medicaid, or who already receives these important programs as a result of special needs. Don’t let your good intention of leaving something behind for someone who needs it to have the unintended effect of causing them to lose this critical government support.

Also referred to as a supplemental needs trust, this tool enables the government benefits recipient to continue getting those services whereas the supplemental care trust can be used to pay for services such as entertainment, internet service, therapies, care manager services, clothing and travel, in addition to goods. Make sure that you have a qualified attorney create your supplemental needs trust for you to ensure that it complies with relevant rules and laws.

What does a future long term care plan look like? If you’re not sure how to answer this question or even figure out what the first few steps are, it’s helpful to speak with a lawyer about what to expect and how to proceed. The support of an attorney can be instrumental in laying out your plan for you.