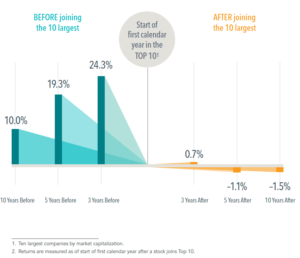

Average Annualized Outperformance of Companies Before and After The First Year They Became One Of The 10 Largest In The US

Compared to Fama/French Total US Market Research Index ,1927–2019

As companies grow to become some of the largest firms trading on

the US stock market, the returns that push them there can be impressive.

But not long after joining the Top 10 largest by market cap, these

stocks, on average, lagged the market.

• From 1927 to 2019, the average annualized return for these

stocks over the three years prior to joining the Top 10 was nearly

25% higher than the market. In the three years after, the edge was

less than 1%.

• Five years after joining the Top 10, these stocks were, on average,

underperforming the market—a stark turnaround from their earlier

advantage. The gap was even wider 10 years out.

• Intel is an illustrative example. The technology giant posted average

annualized excess returns of 29% in the 10 years before the year

it ascended to the Top 10 but, in the next decade, underperformed

the broad market by nearly 6% per year. Similarly, the annualized

excess return of Google five years before it hit the Top 10 droppedby about half in the five years after it joined the list.

Expectations about a firm’s prospects are reflected in its

current stock price. Positive news might lead to additional

price appreciation, but those unexpected changes are

not predictable.

Sources: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.