The picture below was taken at Six Flags Great Adventure on a ride called Kingda Ka. To protect the innocent, I blurred out the faces of my friend as well as the kids who rode with us. I didn’t think it would be right for me to cover my face.

Funny thing, I still remember exactly how I felt at that very moment on the ride. Anybody who’s been on that ride knows it’s a little ridiculous – it goes from 0 to 128 miles per hour in a few seconds.

Then why the heck am I smiling? Clearly, it’s not a comfortable smile. I’m smiling because somewhere deep down inside of me I have confidence that this roller coaster isn’t coming off the tracks. If I didn’t have that confidence, I wouldn’t be excited – I would be fearful. (Okay, honestly speaking – there’s some fear there as well too.)

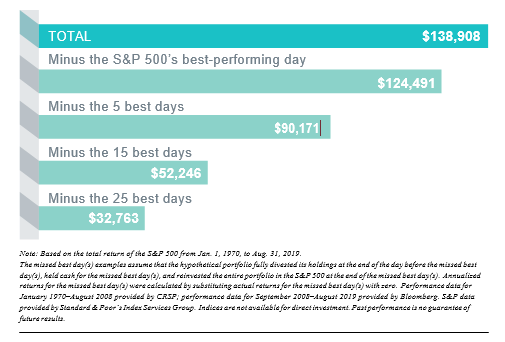

As I type this message, the stock market has had two consecutive down days and drops of almost 2000 points. Even the most confident investors are probably a little fearful. But long-term investors cannot and should not try to predict if this is the start of a longer trend or an isolated time period. The only other 1,000-point drops for the Dow Jones Industrial Average (DJIA) were on February 5th and 8th of 2018. Since then, the DJIA went on to make many new highs. (In case you missed it, I recorded a video about this a few weeks ago: click here

About a hundred years of history tells me, with confidence, that:

A. Roller coasters don’t go off the tracks, and

B. Long-term investors come out ahead in the long run.

When you integrate your legal plan, tax plan, and financial plan you will come out ahead. I’m continuing to watch the markets, but I’m sending this message to remind you that this is not the time to react emotionally.

If you are currently a client and are interested in learning how developments in 2020 on the tax, financial and legal fronts will impact you – we are hosting a dinner event on March 4, 2020. I’m not sharing the details in this email because it’s only open to our clients and their guests. We are keeping the room small and intimate, but if you’re interested in attending please reply and we will get you on the list.