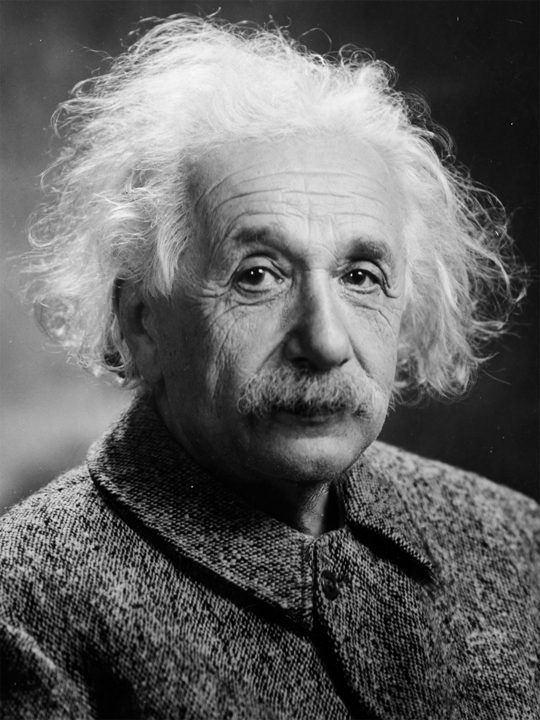

Albert Einstein stated that “compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Most Americans know the benefits of saving and investing early to take advantage of compounding, yet many (if not most) of them don’t.

Why is that?

There’s not just one answer as to why Americans are not investing, but there are some reasons which are given more than others. Most often, the reasons/excuses I hear from clients are:

1) My expenses are just too high. I don’t have anything left over after my expenses to save and invest.

2) I don’t trust the financial industry enough to invest.

3) The market is inflated and it is due for a correction.

4) I cannot emotionally handle the volatility of the market.

I’m not one to dismiss anyone’s reasons for not investing in the market. However, the downside of not investing, and particularly, not starting early, are well-documented. To address each of the items above:

1) If your expenses are too high and you don’t have anything left over after your expenses to save and invest, start with a smaller, disciplined approach. Treat saving for investing as if it was a tax. If the government was taxing you 25%, you could not come up with an excuse that you don’t have enough for those taxes. If you treat investing as something which is not discretionary, but more like an obligation like taxes, you can deduct a small amount from your paycheck or bank account directly to have it invested as part of a disciplined approach.

This strategy is used most often by employees and their 401(k)s or their health insurance. It works because there is no “pain” associated with having to take money out of your account – it was never deposited there in the first place.

2) The financial industry has earned its share of criticism in the media – and much of it is well warranted. The trick is to get yourself in front of a financial advisor whom you can trust. Most often, this is not going to be your local bank or insurance agent.

Ask for referrals and try to find someone who is independent (that is to say, someone who is not obligated to serve the interests of their employer). Ask if they are a fiduciary 100% of the time. If they are a fiduciary, they are required to act in your best interest. If they’re not a fiduciary, they are held to a lower standard-suitability. Even the best hearted people in the industry sometimes have conflicting goals due to mandates by their financial brokerage employer.

One piece of advice a client has given me: “if they have a football stadium or a professional sports arena named after them, chances are they’re not independent.”

3) Is the market inflated? Maybe. Or maybe not. The point is if you make sure that you are invested with the right mix of risk and reward, your investment horizon should be dictating whether or not such a correction (if and when it happens) does not impact your lifestyle.

A 30-year-old investing today can take a substantial amount of risk, particularly with their retirement accounts, because they’re expected to work for a longer period of time. A 55-year-old may need to adjust their risk downward, thereby not subjecting themselves to market fluctuations as much. Even during our most recent financial crisis, from 2007 to 2009, if you held your course and didn’t overreact, today your money would be more than doubled. That’s even if you got in days before the big drop.

The point is: you can’t time the market – nobody has done so consistently over multiple periods, so don’t try. Make sure you stay within your risk zone and rebalance as necessary.

4) Everything sounds great on paper, particularly when it’s backed up by evidence – but the reality is, we are human beings. And you’re entitled to your emotions. It’s important to discuss with your financial advisor how comfortable you are with receiving a statement that shows losses.

As an example, when you exercise strenuously or challenge yourself learning a new skill, there is short-term pain and even some frustration in order for you to get the positive results you’re seeking. Sometimes it might be a bit of an emotional roller coaster. If it’s causing you stress or anxiety, it is probably because you may not know, or may need to be reminded of, the positive results you’re seeking. Knowledge will help with emotional volatility most of the time.

Sometimes, knowledgeable even do that for you. In that case, it’s time to make sure that the risk you are taking is appropriate and necessary. It also helps identify different risk pools – knowing that you have an emergency fund which is adequate, and sometimes more than adequate, can help with the emotional impact involved with investing.

Lastly, if you trust your advisor and you have the right person at the helm, you may not want to check the market on a regular basis. Intraday, intra-week, and intra-month fluctuations have been happening since the beginning of the market. So long as you know you have a long-term goal, there’s no need to suffer anxiety from these short-term fluctuations that may never impact you.