Divorce represents plenty of changes in your life and it can be hard to keep track of all those details.

Any major change in your life should prompt you to reconsider your current will and other estate planning documents. It is vital to update your will at these points in time because you need to verify that your estate plan is up to date overall. If you fail to update your will or other estate planning documents after a divorce, your ex-spouse may legally be entitled to certain assets inside your estate.

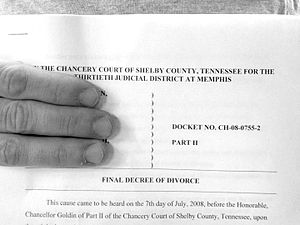

One of the first steps you should take after getting a divorce is to meet with your estate planning lawyer. Many people are relieved to receive their final divorce decree and want to move on with their life but meeting with an estate planning lawyer is critical for protecting your interests and ensuring that you have updated all of your beneficiary designation forms as well. For example, do not forget about retirement accounts or life insurance policies where that same spouse may also be listed as a beneficiary.

If you have other questions about what’s involved in the estate planning process and how you can approach it most effectively following any major change in your life, now is the perfect opportunity to consult with an experienced and dedicated estate planning lawyer. Bring copies of your current documents to your meeting with your estate planning attorney to discuss the next steps you need to take and any other updates that you might need to make.