Software or online programs to help you plan your estate are popping up everywhere, but that doesn’t mean they are the best choice for your needs. Many of these programs lead you to believe that generating your will is easier than it truly is. Heirs might find out too late that your self-created will doesn’t really match up with your state laws or even your own intent.

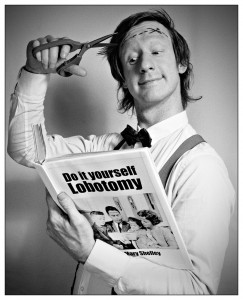

(Photo Credit: rightscale.com)

When it comes to estate planning, intent is everything. Too often, the wishes of an individual don’t come across clearly in self-generated wills. Many modern court cases have focused on the determination of the testator’s intent, but judges are hesitant to cross certain lines to clear up confusion. As a result, your heirs may discover that your wishes aren’t carried out as you planned at all. Simply put, doing your will on your own can have big consequences.

Consider the Estate of George Zeevering. Last fall, a Pennsylvania appellate court was evaluating an unclear DIY will. Since the testator had not worked with a lawyer to generate the document, which was incomplete, it was difficult to determine the true intentions of Mr. Zeevering. In one aspect of the case, property had already been titled in the names of a son and a decedent as joint tenants. Mr. Zeevering stated that “the failure of this will to provide any distribution” to his daughters was done on purpose.

The case got sticky when the residuary and residuary estate totaled over $200,000 after debt payments were made. There was no provision within the DIY will for what should happen to those assets. In the end, the court determined that when a will doesn’t provide for the disposal of an entire estate and fails to include a residuary clause, the residuary estate must be divided under intestacy laws.

This case is but one example of where estate planning on your own can go wrong. Although it may not have been Mr. Zeevering’s intention to distribute the remainder of his estate under intestacy laws, that’s what happened. Despite his wishes, the law overrides an incomplete or improper will. While online and computer programs argue that wills and estate planning documents are easily done on your own, that minimizes the true complexity of document generation and estate laws.

Estate planning can be very complicated for an individual but it’s easily done under the guidance of an estate planning attorney. An added benefit of using a legal professional “in the know” is that he or she is clued into state and federal laws about estate planning, which always have the potential to change. An estate planning attorney is an excellent resource for all your questions as well as giving you the peace of mind that your estate will be carried out in the manner you wish. Cutting corners with a do it yourself tool is your choice, but do so at your own risk. If you want the assurance of totality and legality, contact an estate planning professional today.