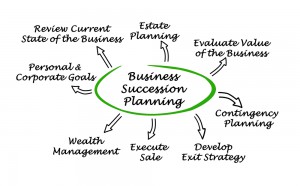

Many small business owners know the struggle of keeping track of multiple priorities working long hours and taking risks. However, even the most successful small business owners can be tempted to drag their feet when it comes to business succession planning. Some of the most common reasons for this process being skipped over are that succession planning is seen as emotionally difficult, time consuming, complex and expensive.

Without a business succession plan, however, you are facing a lot of risk if you do someday hope to have your company survive you or to sell it for a fair price. There is no cookie cutter process you should approach for business succession planning. The amount of time spent in this process depends on the size of the business and the particular issues involved such as whether or not family members will be taking it on. Do not wait too long to get started, however, because this could prove problematic if something happens to you and you need to exit the business suddenly, having a business succession plan in place can help to avoid the challenges with a sudden departure.