Art collectors are celebrating a recent decision handed down from a US Appeals Court which could help to minimize taxes. The court agree that shared ownership in a highly-valued blue chip art collection, which can also be noted as a “fractional interest” enabled one family a critical tax break in the settling of an estate.

The Texas family involved had collected Picassos, Jackson Pollock pieces, and art by Paul Cezanne. The family used a grantor-retained income trust where partial ownership of the art was handed down to each one of their three children. The idea is that shared ownership interest limits the opportunity to sell or transfer the works since this would also require agreement from each child.

The court ruling determined that the deficiency lay with the IRS commissioner’s failure to properly use the discount for restricted ownership in this case, although an earlier tax court had argued that the family was only entitled to a 10 percent discount.

If you have a substantial art collection and are concerned about how it will be passed down to beneficiaries, talking to an estate planning expert could be in your best interest. Contact our offices today to learn about trusts or other vehicles that might work best for you. Request an appointment via email at info@lawesq.net or over the phone 732-521-945

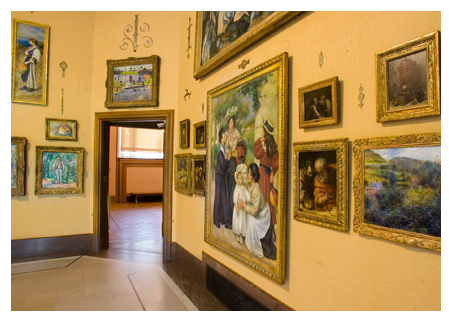

Photo Credit: findingdulcinea.com