Although estate planning is vital for high net worth families, a recent survey released by Spectrum’s Millionaire Corner reveals that less than one quarter of millionaires have sought estate planning advice from their financial advisors.

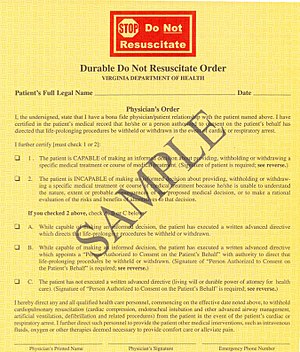

Although estate planning is vital for everybody, it comes as no surprise that it is even more essential for America’s wealthier residents. Estate planning is an important component of financial planning, as it ensures that a person’s assets are managed and distributed according to his or her wishes. Additionally, estate planning allows for a person to provide for the care of any minor children, direct decisions concerning end-of-life care, and select a power of attorney to deal with finances in the case of incapacity.

The younger and least wealthy millionaire investors surveyed indicated that they would seek estate planning advice in the future. However, it is important to remember that the future is not guaranteed. All too often, illness and accidents can cut lives tragically short.

If you do not have an estate plan in place, consider meeting with an estate planning attorney soon. Although it may be difficult to deal with the reality of your own mortality, it is the only way to ensure a smooth transition of your assets and the protection of your family after you are gone.